Overview of China’s Underfloor Heating Film Export Landscape (2025)

China remains the world’s largest production and export base for underfloor heating film, underfloor heating foil, and Floor Heating Reflective Aluminum Film in 2025. With a complete industrial chain that includes heating film technology, insulation materials, aluminum reflective films, and electronic temperature-control systems, China contributes more than 38% of global exports for these categories.

In 2025, China’s total market size for the underfloor heating ecosystem—including heating films, reflective insulation, thermal management modules, and composite barrier films—reaches 48.5 billion RMB, rising 62% compared with 2020. Exports account for 18.43 billion RMB, with Europe and Central Asia contributing 15%, making it the second-largest export region after Southeast Asia.

With increasing adoption in residential heating, commercial building renovation, smart home systems, agricultural greenhouses, and infrastructure heat-retention projects, demand for Underfloor Heating Aluminium Grid Film, Aluminum foil for 50m2 underfloor heating, and Aluminized Reflective Film For Underfloor Heating is accelerating in both Europe and emerging markets such as Russia, Kazakhstan, and Uzbekistan.

Chinese manufacturers—such as Tradsark New Materials (Weifang) Co., Ltd., Warmzone-type heating film producers, graphene heating film companies, and reflective aluminum insulation suppliers—have strengthened their presence in Europe, Central Asia, and South America with high-performance, cost-effective solutions.

Below is a detailed 2025 strategic export analysis.

Global Export Structure and Regional Contributions

European Union Demand for Underfloor Heating Foil and Film Products

The European Union (EU-27) remains one of the world’s most regulated, high-value, and high-performance-oriented import markets for underfloor heating foil, underfloor heating film, and Efficient Aluminum Insulation Film.

European Demand Scale (EU-27)

- Annual import demand: 320 million m²

- Market size: 1.92 billion RMB

- Key country distribution:

- Germany, France, Italy = 63% combined market share

By Country

- Germany:

- Largest European importer

- Annual import: 110 million m²

- Market focus: high-end commercial & premium residential projects

- Price range: 18 RMB/m²

- Strong demand for Underfloor Heating Aluminium Grid Film and intelligent heating systems

- France:

- Strong renovation market

- Annual import: 80 million m²

- Price: 15 RMB/m²

- Heavy use of floor heating film installation in old building transformation

- Italy:

- Luxury residential and boutique hotel market

- Price: up to 22 RMB/m²

- Focus on customized underfloor foil film heating systems

EU Product Trends (2025)

- Preference for:

- Graphene composite underfloor heating film

- Ultra-low thermal conductivity (≤0.026 W/m·K)

- Euroclass A fire-rated insulation materials

- Smart temperature-control modules (Google Home & Alexa compatible)

- Environmentally friendly aluminized reflective films

This market strongly favors premium Chinese manufacturers and suppliers with CE, REACH, and EN13501-1 certifications.

Non-EU Europe and Central Asia: Explosive Growth

Non-EU regions including Russia, Ukraine, Belarus, and the broader Central Asian region (Kazakhstan, Uzbekistan, Kyrgyzstan, Tajikistan, Turkmenistan) are experiencing double-digit growth.

Central Asia Import Growth

- Annual growth rate: 25% (2024–2025)

- Total import volume: 180 million m²

- Market size: 840 million RMB

Key Country Data

Russia

- Import volume: 140 million m²

- Growth in distributor-type heating film systems: 40%

- Increasing demand for:

- Extreme-cold-resistant underfloor heating films

- Aluminum foil 50m2 underfloor heating rolls

- Floor Heating Reflective Aluminum Film for ice-snow areas

- Major use cases: new residential buildings, Siberian winter projects, and underfloor pipe insulation

Kazakhstan

- New housing: 200,000 units planned for 2025

- Heating film demand: 23 million m²

- Growth rate: 38%

- Large usage in:

- Electric floor heating film installation

- Reflective aluminized insulation for extreme cold

Uzbekistan

- Import volume: 12 million m²

- Used mainly for government-funded residential projects

- Price: 9.5 RMB/m²

Central Asia prefers cost-effective Chinese manufacturers with Russian-language support, local warehousing, and high-cold resistance material.

Drivers Behind China’s Booming Underfloor Heating Film Exports

Policy-driven Push in Europe and Central Asia

EU Regulations

- Revised Energy Performance of Buildings Directive (EPBD)

- New buildings must reach zero emissions by 2030

- Existing buildings must reach zero emissions by 2050

- CPR 305/2011 – Construction Products Regulation

- Mandatory testing for:

- Thermal conductivity

- Environmental VOC safety

- Fire resistance

- Mechanical strength

- Mandatory testing for:

- These standards increase demand for:

- Underfloor Heating Aluminium Grid Film

- Efficient Aluminum Insulation Film

- Aluminized Reflective Film For Underfloor Heating

Central Asia Regulations

- Russia 2030 Energy Strategy: building energy consumption must reduce 35%

- Kazakhstan 2025 Housing Plan: 60% of new buildings require electric heating systems

- Strong opportunities for:

- underfloor heating foil

- heating film for extreme climates

- Floor Heating Reflective Aluminum Film

Energy Crisis and Climate Factors Fuel Demand

Europe: Aftermath of Energy Crisis

- Natural gas price surged 70–90% after 2022

- Chinese electric underfloor heating film reduces energy loss by 42%

- Example:

- German 100 m² home using graphene heating film

- Annual cost: €1800

- Saves 40% vs gas heating

Central Asia: Extreme Cold Demand

- Temperatures drop to –30°C to –45°C

- Traditional heating loses 35%+ energy

- China’s extreme-cold heating film can:

- Start at –30°C

- Reach 22°C in 30 minutes

- Maintain <15% heat loss

Also used in:

- Agricultural greenhouses

- Road heating

- Government buildings

- Tunnel construction

Demand for aluminized reflective films for thermal preservation is also rising rapidly.

Market Characteristics: Comparing Europe vs Central Asia

Product Requirements

| Category | European Union | Central Asia |

|---|---|---|

| Key Performance | Thermal conductivity ≤0.028; EN13501-1 A-Class fire resistance; Zero-VOC; ERP top-class energy rating | Low-temperature activation –30°C; rapid heating; 15-year durability; IPX7 waterproof |

| Preferred Forms | Premium graphene films, smart modules, custom sizes | Roll-type heating films, ultra-thin modules |

| Added Features | Google/Alexa control, remote monitoring | Russian UI, anti-freeze protection |

Typical Products

- Europe:

Ultra-low thermal conductivity graphene films integrated with smart APP control - Central Asia:

Carbon-fiber heating films with low-temperature resistance

Certification Requirements: EU vs Central Asia

EU Certification – Strict and Costly

To sell Underfloor Heating Aluminium Grid Film or underfloor heating foil in Europe, Chinese manufacturers must obtain:

1. CE Certification

- Includes EN 13162–13171 test series

- Testing time: 2–3 months

- Cost: €8,000–€12,000

2. REACH Compliance

- SVHC list now includes 250+ restricted substances

- Cost: €50,000–€80,000

- Testing time: 3–6 months

3. Optional Certifications

- Nordic Swan

- German DIN

- French NF

Chinese premium suppliers with complete documentation and ISO9001 systems dominate this segment.

Central Asia (CU-TR / EAC) Certification

- Valid in Russia, Belarus, Kazakhstan

- Cost: 30,000–50,000 RMB

- Time: 1–2 months

- Requirements include:

- Russian-language packaging

- Local after-sales support

- Low-temperature durability tests

Procurement Channels: Europe vs Central Asia

Europe

- 60% brand direct procurement

e.g., Vaillant, Baxi - 30% engineering project bidding

Uses CE-certified underfloor heating films - 10% distributors

Products typically include:

- Aluminum foil 50m2 underfloor heating kits

- floor heating film installation bundles

- Underfloor Heating Aluminium Grid Film rolls

Central Asia

- International heating exhibitions (MIFER Moscow)

- Local warehouse distribution

- 48-hour delivery required by many buyers

- Strong preference for:

- Russian-language manuals

- Roll packaging

- Lower-cost underfloor foil film heating systems

Export Barriers and Solutions

Technological and Certification Barriers

- Long CE/REACH cycles

- Raw material compliance (SVHC issues)

- Low-temperature performance requirements

Solutions:

- Joint certification programs among Chinese SMEs

- Using water-based PU coatings instead of restricted substances

- Partnering with global laboratories such as TÜV and SGS

Trade and Cost Risks

- EU tariffs 6.5–8.5%

- Russia/Kazakhstan 10–15%

- Logistics:

- Europe sea freight: $1800 per container

- Central Asia sea + land: $2200 per container

Competitive Landscape of Chinese Manufacturers

Leading Export-Oriented Manufacturers

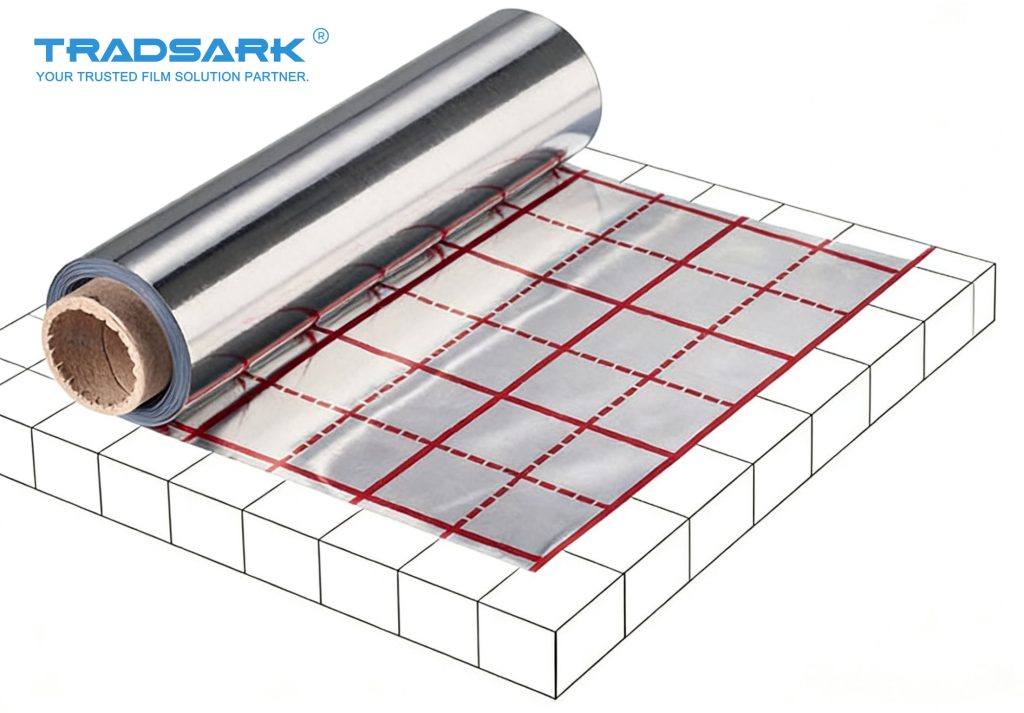

1. Tradsark New Materials (Weifang) Co., Ltd. – China

- Specialization:

- Aluminized Reflective Film For Underfloor Heating

- Underfloor Heating Aluminium Grid Film

- Floor Heating Reflective Aluminum Film

- Export regions:

- Europe, South America, Central Asia

- 12 modern production lines including Brückner BOPP/BOPET

- CE, ISO9001, ISO14001, CANS certified

- Strong in high-barrier aluminum reflective insulation films

2. Warmfloor / Warmzone-type Enterprises

- Specialize in graphene heating films

- Strong presence in Germany and Sweden

3. Qingdao & Shandong Manufacturers

- Known for cost-effective underfloor foil film heating rolls

- Key markets: Russia, Kazakhstan, Uzbekistan

Export Opportunities in South America (Brazil, Chile, Peru, Colombia)

South America is becoming one of the fastest-growing importers of:

- underfloor heating foil

- underfloor heating film

- Aluminum foil 50m2 underfloor heating

- Efficient Aluminum Insulation Film

Market Drivers

- Housing renovation in Brazil and Chile

- Rapid expansion of electric heating in Patagonia and Andean regions

- Energy-saving incentives for residential heating

Top South American Import Markets

- Brazil: high-rise apartments using film-type heating

- Chile: cold southern region heating expansion

- Argentina: Patagonia homes needing reflective aluminum insulation

- Peru/Colombia: mid-temperature heating film installations

Chinese suppliers such as Tradsark are competitively positioned due to:

- Lower freight costs than Europe

- No extreme certification barriers

- High cost-performance ratio

Future Outlook (2025–2030)

Key Trends

- Smart underfloor heating systems controlled via mobile apps

- High-reflectivity aluminum films replacing traditional foam boards

- Extreme-cold underfloor heating films expanding into Russia and Northern Europe

- Zero-emission building standards across the EU pushing demand for:

- Underfloor Heating Aluminium Grid Film

- Efficient Aluminum Insulation Film

- Floor Heating Reflective Aluminum Film

Market Forecast

- Global underfloor heating film market to grow 12–14% CAGR

- China to maintain >65% global production capacity

Conclusion

By 2025, China has strengthened its position as the world’s most important hub for underfloor heating foil, underfloor heating film, Floor Heating Reflective Aluminum Film, and Aluminized Reflective Film For Underfloor Heating exports. Demand from Europe, Central Asia, and South America continues to rise due to energy transitions, extreme-cold climate needs, and home renovation trends.

Chinese manufacturers and suppliers—including Tradsark New Materials (Weifang) Co., Ltd.—are leading the global supply chain with advanced materials, consistent quality, international certifications, and comprehensive reflective insulation solutions.

The global underfloor heating market is poised for robust expansion from 2025 to 2030, and Chinese producers will remain the world’s dominant source for underfloor heating foil heating systems and high-efficiency aluminum insulation films.